Contents

1. BACK TO THE NEW NORMAL

In celebration of the greatest shake-up to the industry since the invention of draught beer, we dedicate this first edition of our new platform to the pursuit of helping the beloved public house return to busy days and happy hours. Clyde Mooney and a cast of many report.

2. NEW NORMAL FOODSERVICE

An essential part of the business model in many of today’s pubs, and perhaps the most vital element during restricted trade for drawing patrons and keeping revenue flowing.

3. SITUATION RENOVATION

There have been new requirements and opportunities for differentiation in pubs working the new normal.

4. COVID-19-RELATED PRODUCTS

We look at some of the new product ideas to emerge for the changed and dynamic public house environment.

5. COVID-19-RELATED SERVICES

New gadgets aren’t the only innovation post-pandemic. We consider some of the new services aiming to help produce better outcomes for operators in these troubled times.

Editors Rant

Welcome back from the whirlwind. As our beloved audience has languished under lockdown, the past three months have brought on an existential change for PubTIC also. At the mercy of government kindness, we have taken the opportunity to reconsider some of the looming challenges in publishing, particularly trade media.

Many will likely have noticed an avalanche of community publications fall into liquidation within days of the national hiatus announcement, as advertisers (understandably) ran for cover, fearing both their own financial survival and the public relations strife that might come from being seen as either not caring or playing up to the crisis. More recently international publishing powerhouse Bauer sold its Australian portfolio, for which it paid around $500 million in recent years, to newcomer to the game Mercury Capital, for around $50 million.

Magazines have long offered a different style of information to daily news, with greater opportunity to elaborate and delve into topics. However, the frenzied charge by Australians to adopt smart phones has largely left the desktop computer gathering dust, and the new-generation of online digital magazines – which are all but unreadable on a phone screen – have already found themselves increasingly obsolete in many markets.

Everyone is being asked to change aspects of their life at the moment, and in that spirit we have adopted and pioneered a new tech-based solution to the hapless magazine that works perfectly on mobile device (phone or tablet) as well as a regular computer monitor.

I welcome feedback on this, our new format, particularly any tech gremlins we may not have eradicated in this our virgin edition. It’s good to be back.

Cheers,

Clyde

clydem@pubtic.com.au

PUBLISHED BY:

The Information Collective

Granville NSW 2142

Australia

PUBLISHING EDITOR:

Clyde Mooney

clyde@pubtic.com.au

GRAPHIC DESIGN:

Therese Lloyd

PRODUCTION:

Clyde Mooney

NATIONAL SALES:

Peter Wiedemann

Disclaimer:

This publication is published by The Information Collective Pty Ltd (the “Publisher”). The Publisher accepts no liability, to the extent permitted by law, for materials appearing in this publication supplied by outside parties. All material is protected by Australian intellectual property laws. Duplication of any part of the publication is prohibited without the written consent of the Publisher.

Reference to products or services in the publication does not amount to the Publisher’s endorsement. Views expressed in the publication do not necessarily represent those of the Publisher, its agents or employees. Use of the information contained within this publication is the sole risk of the person using the information. All terms, conditions, warranties, assurances, statements and representations in relation to the Publisher, its publications and its services, whether express or implied, are expressly excluded, save for those which must be implied under the laws of any State of Australia, or the provisions of Division 2 of Part V of the Trade Practices Act 1974 and any subsequent statutory modification or re-enactment thereof. The Publisher will not be liable, to the extent permitted by law, for any damages including special, exemplary, punitive or consequential (including but not limited to economic loss, or loss of profit, revenue or opportunity) or and indirect loss or damage, even if advised of the possibility of such loss of profits or damages. While every attempt is made to ensure accuracy, to the extent permitted by law, the Publisher excludes all liability for loss resulting from any inaccuracies or false or misleading statements that may appear in this publication.

Copyright © 2020 - The Information Collective Pty Ltd

Post-Pandemic

Back to the new normal

When a novel coronavirus first hit international news in late 2019 the notion it might prove to be the greatest ever upset to the world’s economy was in the minds of very few. Six months later we know so much more and yet still so little, as the realities of a post-pandemic existence and the cat-and-mouse of containment and contact minimisation become a previously unimagined part of everyday life.

After long nights of brainstorming solutions many businesses have found new ground, and at least as many new ideas have arrived to counterbalance those things doomed to pre-COVID history. Being in the business of pleasing people, pubs and their suppliers have been at the forefront of innovation as the public ventures back out from their suburban quarantines.

In celebration of the greatest shake-up to the industry since the invention of draught beer, we dedicate this first edition of our new platform to the pursuit of helping the beloved public house return to busy days and happy hours. Clyde Mooney and a cast of many report.

Seemingly naive in retrospect, Australian life daydreamed through January and February before starting to catch coronavirus fever in mid-March, as startling case numbers began emerging from countries outside of China. Reality began to set in when the annual AHG expo in Brisbane was cancelled, then Ireland cancelled its iconic St Patrick’s Day celebrations.

By 18 March restrictions on patron numbers had begun in Australian venues, and within days they were tightened further to one person per four square metres of floorspace. Three days later that adjustment was out the window as the Prime Minister decreed all non-essential businesses closed until further notice.

Another 48 hours and there were more restrictions, and industry bodies such as the AHA and United Workers Union had begun emergency discussions on the survival of businesses and employees.

Sage wisdom emanated from the Federal Government, pronouncing a massive, unprecedented bailout for people and employers, as many questioned if the economic side-effects might be worse than the disease itself.

Week two in April saw the release of the landmark JobKeeper program, which would become a lifeline for so many over the coming quarter. That month would come to be a procession of state and federal stimulus packages, all with the fundamental motive of sustaining as much of the economy as possible until the virus ‘curve’ receded.

The safety nets kept the lights on and food in the mouths of many, but hindered by the urgency of its introduction, the JobKeeper program in particular presented problems in its definitions, and the terms on repaying employers who must first outlay a month’s wages, often with no incoming revenue. This deterrent contributed to an economic windfall for the Federal Government in the order of tens of billions, as the scale of overestimation in take-up of the scheme by Treasury came to be realised, and desperate businesses called for the scheme to be extended beyond 27 September.

Post-Pandemic

MONEY, MONEY, MONEY

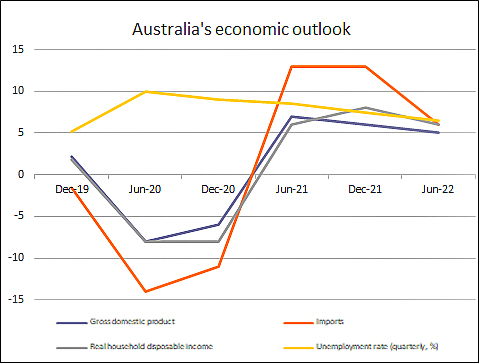

Reserve Bank – Baseline forecast

Every two months the Reserve Bank issues a forecast of the next two years, detailing the outlook for jobs, wages and growth. The most recent was May 2020, covering the peak period of the crisis.

February’s forecasts made only references to the coronavirus, as a potential source of uncertainty, and economic growth was still projected to climb as unemployment dropped below five per cent and household spending increased.

But a lot went awry in the past quarter-year, and the latest results were framed with forecasts coming in the alternate scenarios of the current projected (“baseline”) economic recovery, versus recovery occurring both faster or slower.

One of the most important indicators is employment levels, and here a fall of more than seven per cent was expected during the first half of 2020, with the bulk of this manifesting in the June quarter. Before the crisis there were roughly 13 million Australians in employment, meaning an anticipated 900,000 new people out of work. On the upside, a good proportion were anticipated to be back in employment within a year. Unfortunately, the pragmatic banks are somewhat less optimistic on this point, their forecasts tipping higher unemployment until at least mid-2022.

The RBA’s May figures expected Australia’s pandemic-laden jobless rate would reach double-digits, but with the suppression strategies seeming to have been more effective than everyone expected, the first week of July finds the official unemployment rate at a more manageable 7.1 per cent.

May’s report saw Australia’s baseline economic growth rebounding seven per cent, in a classic ‘V’ from the eight per cent shrink in the June quarter. This would need to assume a strong return in household spending, which represents more than half the country’s gross domestic product.

This expectation could be ambitious, considering the tendency people had (both in Australia and overseas) to increase personal savings after the 2008 financial crash. The pandemic has also strengthened notions of thriftiness and toned-down entertainment options.

But as with employment, a month later has found a better than expected rebound, with the IMF’s World Economic Outlook June 2020 forecasting Australia’s GDP to see a contraction of only 4.5 per cent for the year. In April the IMF had this figure at 6.7 per cent. Furthermore, it suggests our economic growth will rebound sharply, tipped at four per cent growth for 2021.

Post-Pandemic

LONG LIVE THE KING

Australia has been one of the strongest adopters of cashless payment systems, reportedly sixth-highest in the world, likely aided by our tendency to not incorporate tips into some transactions. The coronavirus crisis and subsequent flee from physical contact has put this trend into overdrive, now seen in the vast majority of even small convenience payments.

The writing has been on the wall for printed money around the world for quite a while. Pre-GFC cards accounted for 26 per cent of all transactions, trailing cash at 69 per cent. By 2019 we see almost the complete demise of the use of cheques and the scales flipped, with cards taking 63 per cent and cash down to 27 per cent.

Since the start of the COVID crisis, ATM cash withdrawals are down over 30 per cent, and guided by the call for touchless, many banks and payment providers upped the threshold for tap-and-go, typically meaning no need to enter a PIN for amounts under $200.

However, there is some argument that the fall in cash withdrawals is to a degree temporary; in times of crisis people tend to hoard money to feel secure having cash on hand. The RBA suggests millions have been ‘stockpiled’ – a theory bolstered by the ongoing demand for $100 notes, the $36bn value of them all being greater than all $20- and $10-notes combined.

The youngest working segment of the population grew up in the shadow of the GFC, and to a degree have a greater aversion to debt than their predecessors. They feed significantly into the rising tendency for Australians to pay for things using their own money, notably debit cards over credit.

Despite the rapid increase in cashless payments to 2019, credit giants Visa and Mastercard actually lost market share. This is seen to be largely a result of their failure to recognise a shift and rising gap in the market for new tech-driven ways to buy-now-pay-later.

Perhaps the most successful has been Afterpay, which breaks the purchase into four instalments for the user. Unlike a credit card, it does not charge interest, but there are late fees. This take-control thinking has proven a bit hit with the millennials.

But currently Afterpay charges the merchants a saucy three- to six per cent of the purchase price (as much as 10 times that of a credit-card) and does not allow merchants to pass on the fees to users, meaning Afterpay customers reap the benefit of someone else wearing the cost, which is effectively passed on to all customers. Consumer advocate stalwart Choice recently made a submission to the RBA offering that these systems are “not playing by the same rules” as other payment providers, which hurts both merchants and consumers.

It is highly likely these challenges will be overcome with increased competition in providers, putting downward pressure on the Afterpays of the world to charge less, and dictate less control over retailers passing on platform costs.

One certainty is that these kinds of technology-based products will continue to eat most of the market for using cash in Australian businesses, although it will be years before the lower echelons are able to fully engage in a society devoid of good ol’ fashioned currency notes.

Technology is affecting the consumer environment in more ways than just payment systems, with savvy customers engaging with review sites and easily able to find price comparisons on many common commodities, including meals and drinks at venues.

While the market may largely dictate what price can be charged, tech can also help businesses ensure they are getting the best deal on their own wares. It is often easier to find increased margin in the cost of goods (COGs) over increased turnover.

Barmetrix Troy Kelly

Barmetrix is an Australian company that supplies clients with data to help optimise their margins. It uses a large cache of historical data to identify trends, and reports supplier price changes to its clients. Comparison also makes it able to benchmark what a client is paying against competitors, and how their retail prices stack up against competitors.

The company incorporates a sophisticated ordering platform that uses your sales data to set and maintain par levels, avoiding over ordering and reducing unnecessary cash outlay. The services go beyond a POS report, able to include stock on hand and ‘unexplained variance’, offering an in-depth look at how the business is trending when compared to the previous month, quarter or year.

“Every penny counts right now,” says Barmetrix principal Troy Kelly. “It's about managing the financial risk in these uncertain times, and if you don't have inventory analytics, your risk is too great.”

Another AGE

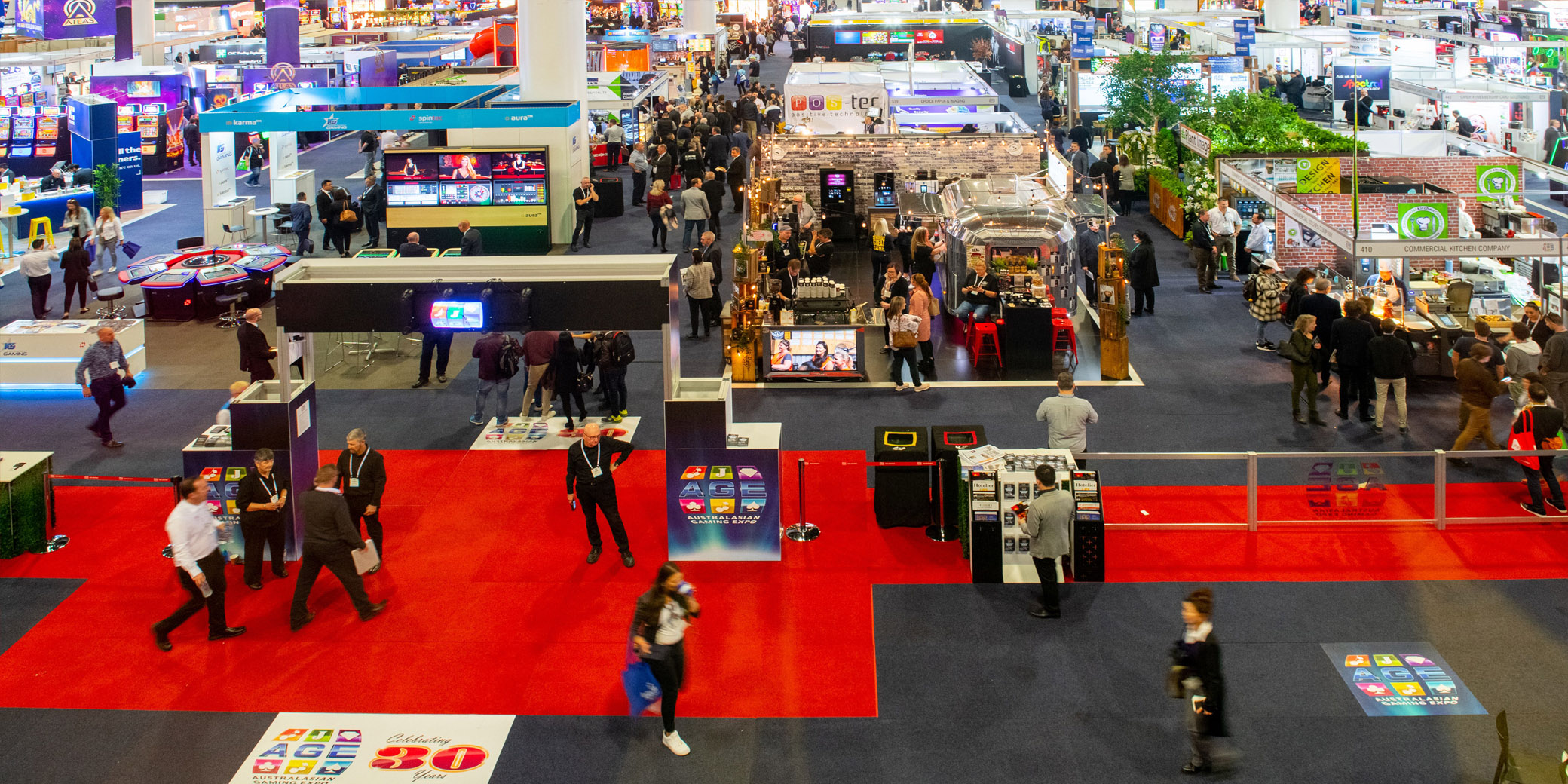

For the first time in decades, the Australasian Gaming Expo (AGE) will not go ahead this August.

The 31st AGE was set to take place at the ICC in Sydney from 11-13 August, but as per the Public Health Order issued by the NSW Government on 14 May, large gatherings will not be allowed again until the 14th – effectively precluding the Expo, scheduled to showcase over 200 exhibitors and welcome thousands of visitors.

A shorter postponement was considered, but it stood to conflict with other events at the ICC and in the industry calendar, and the decision was made to hold off until next year.

The next instalment of gaming and hospitality, replete with “razzmatazz”, will take place 10-12 August 2021.

RAISING THE BAR

In June global drinks giant Diageo announced a US$100 million ‘Raising the Bar’ support program to boost licensed premises around the world, with $11.5 million destined for Australia. Diageo Australia is presenting through iconic Aussie brand Bundaberg Rum

From the start of this month, any licensed venue in Australia – regional or metro, regardless of whether they stock Bundaberg Rum or Diageo or not – can apply for support through the two-year programme supporting jobs, recovery, and innovation in hospitality.

It will offer free access to digital training and practical support through Diageo Bar Academy, including best-practice topics such as implementing social distancing, enhancing hygiene measures and optimising business recovery, with content regularly updated to ensure it is latest best-practise.

The fund will also pay for physical equipment, including: ‘Hygiene kits’ (high-quality permanent sanitiser dispensers, medical-grade hand sanitiser, range of PPE), contactless mobile device platforms (table booking, digital menus, cashless payment systems), outdoor equipment (mobile bars, heaters, coverings, furniture), ventilation systems for indoor air cleaning, and temperature scanners, perspex screens, and more.

Diageo notes Australian pubs, clubs and bars contribute $17.2 billion to the economy (pre-coronavirus), employing over half a million people, representing eight per cent of the workforce.

“Our hospitality industry sits at the heart of our community and Australian culture,” says Angus McPherson, Diageo Australia MD.

“The joy of being able to connect with friends and family down at the ‘local’ has been sorely missed throughout this pandemic, while the economic impact on the industry has been unprecedented.”

Government and industry have praised the programme, including the Hon. Michaelia Cash (Senator and Minister for Employment, Skills, Small and Family Business), the Hon. Dominic Perrottet MP (NSW Treasurer), and John Whelan, AHA NSW CEO.

“Support like the ‘Raising the Bar’ initiative is exactly what we need to help our Australian hotels get back on their feet, employing people and contributing to the Australian economy.”

REAL ESTATE SNAPSHOT

Q2 of 2020 has been an understandably quiet period in pub real estate, finding few transactions as operators focus on surviving the closure period and recognise the folly in valuing assets with no immediate revenue. Many deals on the verge of finalising as the COVID hammer fell subsequently fell over, notably AVC’s agreement to purchase the prized Sand Hill Road portfolio for circa $75 million.

Some fear there could be a wave of financial stress-related sales in the second half of the year, but entering Q3 distressed listings have not begun, while many ‘on-hold’ deals are quietly back in negotiation.

Sydney and NSW continue to dominate sales volume and dollar value, and strong regional areas in many states look set to enjoy some benefits from the fact international travel will be virtually non-existent for some time, and even interstate travel remains limited.

“The NSW hotels market is still very much a demand-driven vehicle,” reports Manenti Quinlan’s Leonard Bongiovanni. “Sydney remains coveted with purchasers continually seeking opportunities while there is a limited supply.

Leonard Bongiovanni

“We are also seeing a renewed appetite for quality leasehold venues, and fielding numerous requests from both newcomers and established operators, favouring a leasehold acquisition due to the smaller capital outlay initially required.

“Regional assets in strong areas also continue to generate a strong level of interest.”

![}ÒíßGÒkÍÛ=Öcü"³Ô«Ç}wãµmn¸0×ka°]öÚö±»þé¯ê+ã¥0néyãeË}7:ÏcÛËY³m¬ÜßæÞÝ÷X?]z3qòÊÙSö¢Çíõ*imlôéôwï§~G¨ÏÓ6¢ÉîÂT#q#ýöÿ.y9âd!#ÅÃÃþn|Üý?á¹ø?Vþ°çâbçb:ÖæAuG¥þÙ½úô.«Ò:îWO«1ì99cÞòwJ·5ÛÚÝ·1®÷?zézwÚúfůËÙK(¾XÇRë,´¾ª>Ñ[þÙëz~jTÁê}BÆÞ+²¼7qË+®»m¯ô¹ÛKkõ?Fÿø½ïU1Ï<Ïø=<Äkõ0ãöL²q~¡G´%ã¨×Uŧõ¯ÙXvnÞCC%®ÈhݬÚÝË8ÝÓz¸½á¯Êõ¯x|½®{@s÷úߤïô¿ªÏê.îúÿûtÿ´µ®²-Ë.nóK¤ã»ÑõYvö?õ¶ße¶;þåK¦á72¼¼üÇ6ÆÛo¨ýÂÇNçºÝÃs½ÿ¤Øÿúâ»!)Âw-§?êþÎÁÅÃ(ÜÁ¾Ð0áñr:¾mÝk¨Ýʢ̢+¦7sJû²ùÿæ-:zÆ5X±úÛë¹XìþÃI%7ÌSSïÑïõ=Þßô ÅéyXêꡦ2ª´Á%®nìXG³ÔöÿéMêàgC¨5õãq_V¯5ìeÖZë6z®zvïw¦×;~Ê}£ÜÊÁm¶:«Xý¾ç{6³ôjuØÌ:i©ÙìÈ°gòw[!û¬¿ù¿çýÇk¿Güçø4fäáSCX²½JjÈ7T×SrXáú*¬k±ïý]D·$f2ü|¬;ßUµÞêKMu7ì¹lúm£~ÿ¦ª7¨SuYLwèY_N·m¾¥sÜË=7ý²Ïôu7è%}æîÓ±Î@m

÷¶íÖ,µï Ö~Þ§zo°x¸¿ñ¤Ø"øÍU¼¥.G÷¿Ê¶2s1ó

âÑv9ËÉ®ü`Ú¥ÌemÄ`=ßcþÔB£>.ÅÈsn9].+í¯Úö³Ôc.¶ÝÛ±OúÞö+y9½6ëqÍ7·¦åÓé`û05Qh¡û®ÊßGÚßoú%OôuëV5µäãæÍV5±ÁõWd}.Ýú6÷ +¨>_§þx®Á×æúñqá¨1F=¹Ý?!ïÅÆ®©ø{¿ì÷Ñýewé?M¹¿ÔTÆfKzìç}L|ëåkXAôéµä{öÝö2«ºñgGÆÇõç®õkõàÍÛ»vÏôhS?í¸K=KG¯Y©vCCq+}ÍÿïB½þýqbÅÜ¿ÅàÙªÐקün>&ë ;yáJ²;ÙEã'Qʪ?½LÆCÿÒ±a@1YÑ>ðÖ:|¬Üó¶4uñÖïØÝÑ¡#Og«Óeý_gò¦Qu¢ è®XãSFÃ5}&þcjkõ^kÞÖi;a¼ÏöëŹ 4¾¡êXÓ¨ïýÏí kcK¢ ÚöM^vK»m^íºj7ù¾ÏnÔ³2¬X{Üë#ÓoÒ-ØïÍú?ÌþsùÅ:h´±5õ¹¯;7ûÆòÖ±»õ½ÉßñfÐúZí]»Õh:éÕÜá×e=7GöÌë5¿adhÆ4è6°nvÚÛôÃjqÖÖæûAÀcqÙý³ïSY%Íeo¨¹ðÐ=@ô6}/jV:P õ²~Ô,F¿AĺtÇ(Ž¬TZçlpÚë}Çó=üä7Ñk]7}¹ÿE¿ÔÙÿè£Ùsh¬÷óQsZçϺtE³%¡¡ÖÒdpÒën.üÖ»ù¿ë§8I²çR=VCºhöknl;°nQ,sXÎ wFf ²Ë*k:Hs¤¼UÌ+k.ý-Oh! %Åãù½ïþm!µ 5¦qÚ5ðPnÑ30#ÁìVHiv 8ñ?/ö+{êkv´8n;d9¾}ÍõбӪ¨öÙbF¿ä4ñG4êTí¯/µ¯ö¹ñí÷ìþº1ZLÕ{H÷à4þrBîÒAª¤é AîçèÄ|uÓä¤í}04uÿÓ´FíRkÅ,>Ý?'ç 5ÛQ6Ú»á·ãÊÙ {%?èí%ÌmÒ77_ÎÛüeÖ´¹§Ð¤Dúm?¹ù.,É{Ûq¤±,ÆOø=¾ï¦}¡svåØMgsf®ä9?sØ÷}$Éo·OðùNµ¯]ÙUm ×^àFàÀÒ'÷5Ûý¤?¶z¤~¯à5OIÿ;÷U6±Ã-Î>æ¸ú ½êÜ73þcýÿúY8¶¢ïµ=ÎGèØíÍØÏßoïÿ!.Òÿ½W]ÿèÿß0nPk¤WK?ÂáÿYÏsÇö{êw^×µp&!²c{úWeZÚ=Q}Q.ØêX[¼kw4}¢Hé¿÷¿ïU0]¿»ÿ|æ¸ Ñ.í'îSÀsZN -ÝUMµÕd:Ë>ëhvVÁígè[ûÿ¤ú5/´×c×æ>ÆX]4A þsLµÍ³DLÏoÏþõ¿åÿ|иmkÈm:ëÂ-.Ú Ùiäæn°7ísêê@h¿ÔþS½Îÿ§û,ÊÓoÛKZÆ·i4ÅÛ£cÝú?ç7ä5·ý/ûÕ/ú?÷ÍZÜÒÆX®£²¥®váG´ x-µ¼m#-Ƨ:=4löØÍ6ÿÁ'vS7sÉl¤m þÓú>ßÒ;ôGOú_÷© ¿ýû÷(íxEkjH$ÀóQÜýlpsà«v5»tö4ÄAÔ²äPruÚÞüþj'·ãýÿ{ÿBkÜæ£î4*¶ ÞßêÎ^SYèîCôZ w{£w»r¨Ö6@äÿ¹ È?pÚíd:êck× Ý¯xé%òA-Èh9ïq JÿÔô>ÐØRN¿>¾Am8Á.!i¾Ðku¦íþp3è¹ÊèÇû~Íä3s«kfÏäû+}_Mf×mÎm î÷wm5-ßü¯ ßå«¿dÊcI.qi npÈþsgÒÝíÿH-÷¥ñml[fóîúcÚxlûtoçý$Ò_¶¬³Û´lݼÇèîý§±ûÿáY¬·0¿lØ$>O»óiÃË`hÎQ Áý?ÝBÿ¬_Õ-¯²Ôá[ÙVKÛcK½Ï³üö ý¸Söv¹» fÝíÝùPûo¦ù v°èþwÑýÔ6^ðvíw§KZZݧù~ä¿Âÿ¬ìG¿GãcèhÝf#÷¿G³jv·lxÛ¡dÈ<mP¿.CAͳÝô÷;ôMR§42ѹÄÀsÄè5.å+¬éõ)q°Ü Ý°[»ÙÏçú_õ `ïf¶C·ÎÝÄÇèâ=Zÿm¶àe+öçíC±Çú»ô7t¼ÐòÍ&vïl`¤Ç÷¿µ/ÝüléÖ6Xo ú<Pì"ÏU¦[»vÒ6Ͼ}Û¶}*±sCe 5²é%ÍCs,Óéý*Òýð ¶"7xù¥é¥ø¤ñÑü°ôÐò/pìéhðú¤ä`n0ëÁ´´Ùá»Áiþ^ôÏé¹Jí÷tkìJ¼<·æ4ÝùÍi,-ýöíjWÞüURýßÁ#GNqÂð<%$bB-ï¬òÒß䨿)/{D@sK rvæߢ£f-ÔÚHgÑ3Á,ëlz@ÞÔA¯]i.RcvÉðQmhíGOM¨SÿÕ·HÙH'¾¿Üª+Ä14Ñl¸á±AkZëm¢Øù;Ú[îj×Öæ¸zZçK =¿¹¨8õdädWhq¢{Þ÷¢Æ1»Ü¬UÓó2oƧÜ{Û,ô2çzdÕÕ¿ÛêWcâýèHÄnkKÝ1³°¾1»#5Îf-ÞI×ów{Pë¶Ã¦Øs?0ÛýFÌwö*éÙ¶cî7$;ÆC,ÑßØBÆ¥ù×äW¸](https://webazine.pubtic.com.au/wp-content/uploads/2020/07/GTA-AGE2020_W007fpah.jpg)