MAJOR FEATURE

Pub Real Estate ...

a New Era

Furthering the ongoing trend toward consolidation, in a continued low interest economic environment, the most calamitous thing to ever happen to pubs unwittingly brought about the biggest upheaval in living memory in hotel and commercial real estate. Clyde Mooney takes a look under the hood

The real estate market in 2020 started normally enough, with a typical spread of sales and acquisitions. The Thorpe family parted with their long-held institution, the Harbord Beach Hotel, the Doyle family sold the Family Hotel after 37 years, and the world famous Birdsville Hotel sold to a conglomerate of outback entrepreneurs.

But already there were signs of a shift in the usual patterns of behaviour, in particular more consolidation of assets with aspiring groups, increasingly leading to exploration outside their home base. Ray Reilly ventured beyond the inner west, buying the Sutton Forest Inn. Tilley and Wills went north of the NSW border, taking Brisbane’s Elephant. And the big Australian, ALH, added to its 330-odd collection with two more in the Queensland’s south-west and mid-north.

Late March the pandemic ended all normality, and barring a few transactions already in planning that staggered over the line while pubs were shut, the real estate landscape understandably saw a drought for the next few months. During that time the only surety was continued uncertainty as to how much the pandemic would impact hospitality, and indeed if it would ever return to normal; no-one could know how the values and future potential of these valued assets would fare.

In this feature we are looking at some of the big picture effects COVID-19 has had on the broader market, as Australia enjoys the benefits of what will hopefully be continued containment of the virus.

There was already limited stock in metropolitan markets, and we’ve been experiencing a record low interest rate environment for a couple of years. The biggest change brought on by COVID was the accelerated shift to remote working, further boosted by opportune technological advancements racing to market.

The increased popularity of ‘work from home’ comes as no surprise, but what the pandemic and shut-downs did was force employers to allow workers to work from home. This artificially created an ideal evolution of the model, and made a lot of businesses realise that employees do actually do their work when unsupervised, but also that there are potentially significant cost benefits, such as less need for expensive office real estate.

The newfound flexibility in the physical location of many employees has given rise to an upward trend in domestic migration, while closed international and state borders have simultaneously benefited domestic tourism. The

MAJOR FEATURE

posterchild for this is Australia’s current international hotspot, Byron Bay, where the median house price rose a startling 21.9 per cent in the year to April 2021 to $1.4m – surpassing Sydney, at $1.1m.

A report by CoreLogic details property prices in Australia’s regions have risen 13 per cent this financial year, versus capital city growth of only 6.4 per cent.

Mid-shutdown, few would have predicted that pub prices would soon be soaring. Benefitting from a population starved of social activity and largely cashed up due to an inability to go out and spend, despite being among the first to close and last to reopen, the pub industry soon saw money flowing back into the tills and quickly bounced back.

Something of a victim to the new trend, many CBD venues have seen the downside of fewer people in the hearts of cities; a March report by Spatial Source had foot traffic compared to pre-COVID at 68 per cent in Brisbane, 47 per cent in Sydney and only 39 per cent in Melbourne. Data from digital-ordering platform me&u reported CBD revenues down 23 per cent on pre-COVID levels, compared to a 14 per cent surge throughout suburban and regional venues.

Australian Venue Co said in January its CBD venues in Melbourne and Sydney had only returned to 65 per cent of last year’s sales, but have been offset by really strong trade in regional and suburban areas, likely underpinned by the number of people working from home.

Ever the opportunists, the ‘flight from the capitals’ has given rise to an appetite amongst prudent purchasers to seek opportunities outside the traditional catchments. In fact, many have said we are in the midst of a boom across the east, with conditions not seen since before the GFC.

2019 set a record for the Australian pub real estate market, achieving $1.3bn in transactions. FY20, encompassing the shutdown period, tallied a respectable $1.15bn.

As community spread of the disease in Australia remains absent or at least immediately contained, allowing business to return and employment to stabilise (5.6% at March 2021 – a low since late 2017), many feel we have dodged a bullet. This confidence can be seen in the fact that FY21 is set to be another record year for pub real estate. The difference now is that many of the rules around value and potential have changed.

Freehold going concerns

Sydney

While Sydney sees a continued shortage of pubs on the market, the reality check that came with pubs being forcibly shut down for the first time in history has motivated some hold-out sellers.

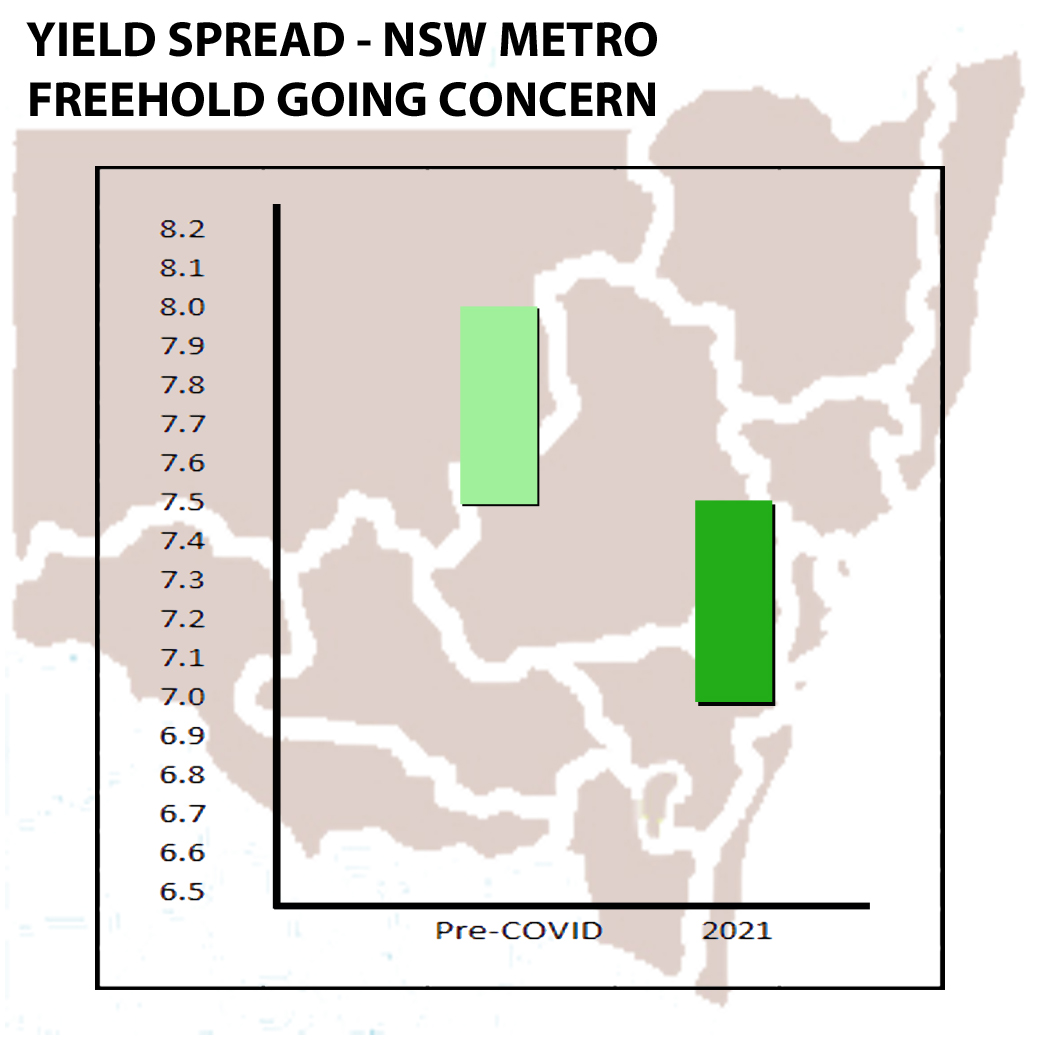

Graph data courtesy HTL Property

Meanwhile, the uplift seen in so many large suburban operations has driven further yield contraction. Figures put this at around another 50 basis points, down from 7.5 per cent to 7.0. A survey by Savills Australia found over half (52%) of respondents would expect yield of 7.5 per cent or lower for a freehold going concern gaming pub in Sydney.

Gaming Pubs

Gaming continues to underpin the value of hotels across all market segments, in all eastern states – from prime A-grade metro to far regional. Relatively free of any serious legislative hurdles on the horizon, even the developments of cashless gaming and restricted smoking, and the continued push for voluntary pre-commitment schemes, have done little to slow the market.

HTL Property reports EGM entitlements have seen a rapid increase in price post-COVID. Values prior to the pandemic were at $250k per unit landed. This dropped as low as $225k following the lockdown, but has rebounded since to $285-300k per metro entitlement (landed). Permits continue to command a $25-50k premium to entitlements.

General Market

For the most part, the steadfastly increasing prices and asset churn has benefited the consolidation to the larger groups, increasingly leading to a diminishing pool of actual owners. As virtually every owner of a Top300 pub is a buyer not a seller, it becomes increasingly unlikely any of them are put up for sale. Adding to this, the subdued investment environment can be a demotivator for holders of an asset growing in value.

MAJOR FEATURE

“Whilst low interest rates are spurring on the buyers, this fact obviously also does stop some vendors,” says HTL director Dan Dragicevich.

“A fairly standard response from an unmotivated seller is ‘what am I going to do with the cash? … can't put it in the bank’. Although a record sale price might look good on face value, often times the amount left after tax and other costs doesn't come close to the return achieved remaining in an asset.”

HIGHLIGHTS

TATTS PENRITH SELLS TO OSCARS’ BMG

REDCAPE TEMPTS COOTES OUT OF THE GLADDY

IRIS NABS BIGGEST BUY NARWEE HOTEL

O’DONOGHUES EMU PLAINS JOINS REDCAPE FOR $31m

WINDFALL FOR ENGADINE TAVERN SALE

LAUNDY TOPS BIDDERS FOR BIDWILL

JDA WINS BATTLE TO GENERAL GORDON

YOUNG CATCHES GALLAGHER’S ROYAL RYDE

LEWIS LEAPS INTO RAMADAMelbourne

Despite being somewhat different to Sydney, in terms of most pub operations being tenancies rather than freehold going concerns, CBRE’s Mat George reports there has been a significant amount of capital around looking to be placed, including a lot of interest in premium-grade Victorian gaming pubs coming from interstate. Buoyed by the record low interest rates and ongoing lack of opportunities, this is pushing prices higher.

Similarly to NSW, city groups have been showing greater interest in regional locations, both in Victoria and beyond.

“Several NSW-based groups are looking closely at a number of high-value off-market opportunities, driven by the distinct lack of opportunities in metro NSW,” says George. “They are showing a willingness to expand interstate now more than ever, primarily toward their portfolio’s income and EBITDA, as opposed to chasing yield.

“Importantly, the NSW buyers are predominantly trying to snare large freehold going concern pubs that can be easier to operate under management.

“Some Victorian-based operators are now expanding into South Australia, citing better buying conditions on offer than in Victoria. The pubs in SA are all considered to have value-add opportunities, and are typically priced in the sub-$5m bracket.

“Pub Groups like Melbourne-based Black Rhino can embark on overdue capex, upgrading facilities and product and generously repositioning their venues’ amenity to better suit their local patrons and communities.”

Bimbo Deluxe

Brisbane

Continuing the trend seen in Victoria, CBRE said in its 2020 Pub Trends report Queensland is finding NSW operators continue to pursue portfolio expansion, with the state proving to be a “fertile hunting ground” for growth opportunities.

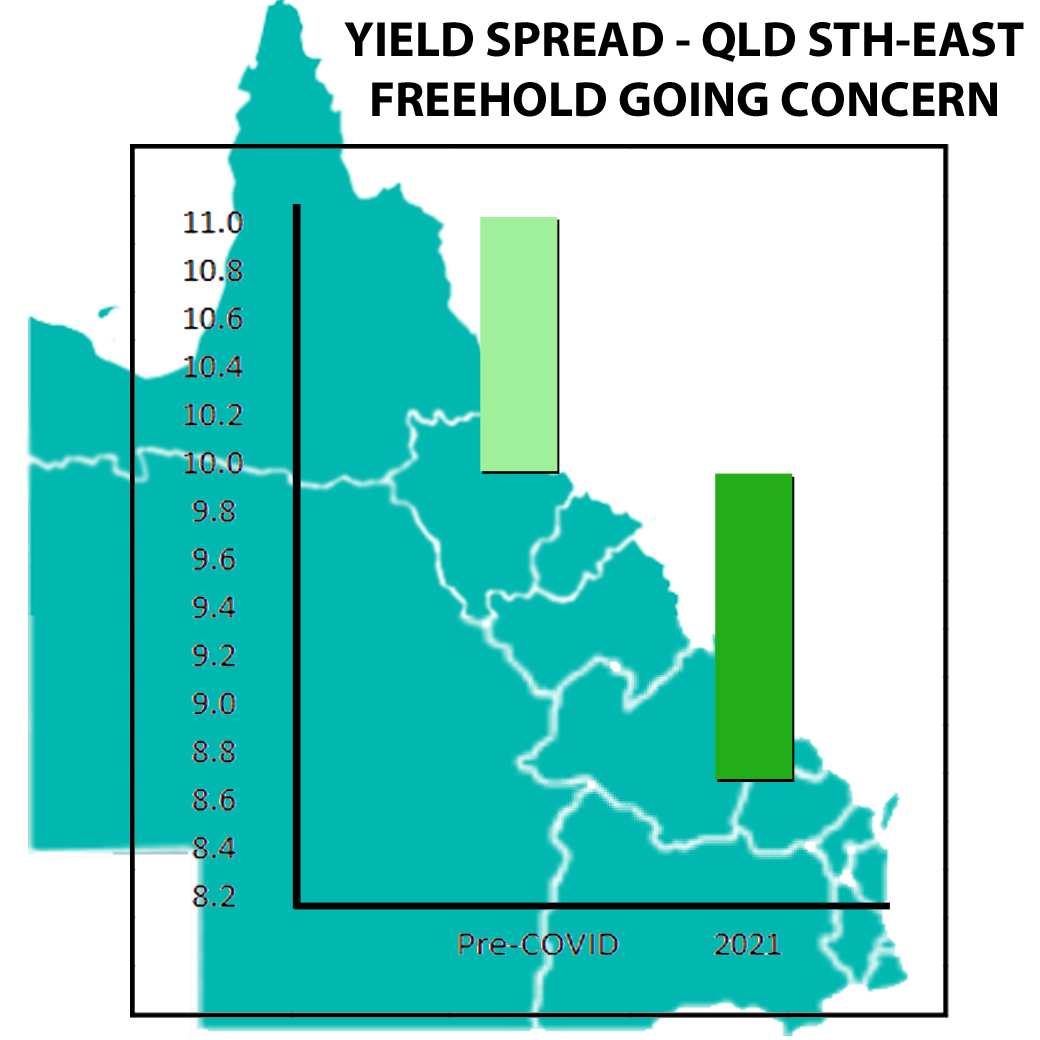

Queensland’s sheer size and demographic spread fosters three different sectors, being: south-east, coastal, and western. Brisbane has not seen a lot of transactions, but the south-east in general has seen yield compression up to 200 basis points, sharpening to 8.5-10 per cent.

As with all markets outside WA, the significant assets continue to be those with gaming, and potentially also harnessing a large-format f&b operation.

Brisbane and large regional centres are also following NSW and Victoria in the continued corporate push, and well-funded vehicles such as those behind AVC, ALH and HPI continue to apply capital. As NSW presents fewer candidates for a quick uplift, the sunshine state is offering lifestyle and opportunities.

“There has been a growing influx of people from Melbourne, South Australia and especially NSW – trying to find that next Byron,” offers HTL’s Brisbane-based director, Glenn Price. “Market depth across all sectors is as large as it has been in the last decade.”

MAJOR FEATURE

The hot market also gives rise to a certain gold-plated competition for the kind of very rarely traded ‘trophy assets’ found particularly in Queensland but also NSW, with appetite fierce in both states.

“Someone is likely to pay an out of line price just to secure a

holding that may not be available for another 20 years,” says Price.

Coastal NSW

ABS figures on migration within Australia reveal a net loss of over 11k people from the capital cities during Q3 2020. Sydney saw the highest exodus, losing 7,800, while Brisbane actually had a net increase of 3,200 residents.

Regions to benefit from the migration include NSW's Hunter Valley, the southern highlands, the northern rivers region, parts of coastal Queensland and even some inland areas, such as Orange-Mudgee.

A ‘perfect storm’ of factors saw Sydney pub giants Arthur Laundy and Fraser Short pay a whopping $40m for the Lennox Hotel, near Byron Bay. Beyond being absolute beachfront and posing significant upside through the right capex, as well as being so

MAJOR FEATURE

close to the real estate flavour of month, the successful hoteliers had plenty of headroom in plenty of their other considerable assets, and Short, who increasingly finds himself in the area and already owns Byron’s The Farm, was in the unusual situation of being a local publican without a pub.

In the other direction from Sydney, one of the true moguls of Australian pub real estate, Justin Hemmes, began his business beyond the capital with purchase of Narooma’s The Quarterdeck, on the NSW South Coast.

“One of the silver linings to come out of the last year is a heightened appreciation for our own backyard,” said the Merivale chief executive.

The huge uplift being seen in Coastal pubs is a result of several influences; town size and infrastructure are key, even in the context of extensive migration, as fewer newcomers will be drawn to homes devoid of too many city conveniences. A certain exception to this is the proximity of idyllic locations to a major hub, as the reduced need for a daily commute makes a semi-regular drive to a nearby larger community more palatable.

Just as Sydney metro yields have contracted 50 basis points, the Coastal market has tightened from nine per cent to more like 8.5 per cent. The largest compression has been seen in Wollongong and surrounds, the central coast and Newcastle, Port Macquarie, Coffs Harbour, and of course, Byron Bay.

While these areas have been affected by the surge in population relocation, there continues to be something of a ‘recipe card’ for desirable candidates, specifying decent site area, more than 20

gaming machines, off-street carpark, and tavern-style operation.

This formula has been cooking for a while and underdone situations are scarce.

“The Coastal market is now mirroring metro in a lot of ways,” says HTL’s Dan Dragicevich. “There are multiple common players and the transactional activity is a repeat of that found in town.

“Assets are now turning over a second and third time in the last decade, as the baton is passed between buyers who look to add their own strategic capex in order to get further growth.”

Arguably the pioneer of this trend is pub king Arthur Laundy, who has long held strategic assets up and down the coast. Dragicevich has brokered sale of the Swansea three times to a succession of opportunities; husband and wife owner-operators sold it for $6.5m in 2012, Phil Burnie bought it three years later, renovated it then sadly passed away, his estate sold to the Laundys for $12.5m and recently they sold to Paul Hunter for $20m.

A certain hopefulness has crept into the minds of long-held pubs in NSW coastal areas, but without doubt those vendors with the right boxes ticked know what they’ve got and ain’t takin’ any low-ball offers.

HIGHLIGHTS

LAUNDYS PASS SWANSEA TO HUNTERS

SHORT AND LAUNDY SPLASH AT LENNOX HEAD

LAUNDY TINDALL SHORT SEE WISDOM IN EVANS HEAD

SHORT O’HARA MALOUF GO AGAIN IN COFFSRegional NSW

Not everyone can afford, or is even necessarily looking, for a sea change. Inland precincts with lifestyle and value benefits are also being affected by migration and consequent cost increases through competition.

Flight from the capitals has affected larger regional centres more than the towns, as city-siders opt for better value residential properties that also have the necessary modern infrastructure, particularly reliable broadband.

“Regional and coastal cities have benefited from border closures, with an explosion of intrastate tourism,” observes Manenti Quinlan’s Leonard Bongiovanni.

“While some metropolitan areas are still bouncing back from the effects of the COVID restrictions, strong regional hotels are seen to have evaded substantial declines and continued to trade solidly on the back of local trade, and the robust intrastate tourist trade.”

Every town has its unique disposition, in terms of desirability, geographic location and potential so it is impossible to give hard data on yield compression, however it is thought that while Sydney and the Coast of NSW have sharpened 50 points, the best regional centres have seen a reduction more in the region of 100-200 points.

This has led to some degree its own two-speed market, with most smaller communities in a distinct state of either growth or decline.

MAJOR FEATURE

Many towns built around a mining boom or periodical benefit that may once have flourished are fading, as the resources are exhausted or the benefit shifts to another commodity or location. Less commonly, some smaller communities are growing as a new trend puts them in the spotlight.

Many have lamented the decommissioning – effectively culling – of the less viable pubs in fading towns, but in many cases the freehold owners that elect to sell have seen it coming for some time and may at least benefit from the capital being reclaimed from largely unprofitable gaming machines, following the changes allowing easier transfer of entitlements between venues.

Moving gaming licences from under-performing pubs to one elsewhere in town, into a different town or even to the city, has commonly led to the owner of the establishment getting a big cheque for those machines. The building can then be sold separately, potentially generating a higher end figure than would have been paid for the pub as a freehold going concern.

“The highest bidder dictates what the final ‘use’ of a venue is when it transacts,” says HTL’s Blake Edwards.

“With the price surge of gaming entitlements, sometimes the highest use of a venue is not as a trading pub, but as a ‘break up’ of the gaming entitlements and underlying real estate. In these cases the entitlements go to a bigger more successful venue and the building normally isn't viable as a pub anymore.”

There are some occasions where pubs stripped of their egms can continue to operate, although most commonly they become a different form of commercial space. Those that were or can do good trade in accommodation may have some potential, particularly if they include a healthy portion of f&b, offering a tourism-focused destination. These assets are going cheap, and with scale could prove a successful model for the right operator.

Optimistically, the upside of the dying of so many country pubs is that those remaining become increasingly viable.

“We have also seen an increase in demand for entry level hotels from people looking to enter the pub space from non-hospitality-based backgrounds,” furthers Bongiovanni. “They see the opportunity to purchase a freehold property generating a profit, while working for themselves, as an attractive drawcard.”

Another driver for the decommissioning of under-performing regional pubs is the number of greenfield builds going on in and around Sydney.

These new operations in new suburbs are limited to acquiring gaming machines that were on the floor somewhere else in the state, and the best place to get them is from pubs where they are not making much money for the owner.

Perhaps the only mitigating factor here is that the major operators building brand-new pubs, such as Laundy and Iris, are disinclined to be left holding and have to sell a non-viable pub in a country town.

HIGHLIGHTS

HARVEST EXPANSION ON TRACK IN ALBURY

MARLOW CAPTURES FRESH FIELDS WITH ROBIN HOOD

NEW INVESTMENT GROUP TAKES MPK PORT IN MASSIVE DEAL

A MILESTONE FOR HARVEST IN DUBBOCoastal Queensland

The exhaustion of NSW Coastal opportunities has certainly spilled over into Queensland, particularly in mixed-use assets, such as those with a significant accommodation aspect, which are being hotly contested.

Strong Coastal Queensland regions have witnessed yield compression in the region of 150 basis points, to a range of

MAJOR FEATURE

10-12.5 per cent. Effectively, this largely makes for where the opportunities are presenting, given up to 200 bps compression is being seen in the south-east.

“Large regional centres – the big country towns like Toowoomba, Roma and Airlie Beach – are the sort of areas where there’s a big focus to drive yield, on good quality holdings,” says HTL’s Brent McCarthy.

“The other source of opportunities is in areas with decent population, where a corporate buyer, or private, can grab multiple venues in a town, getting immediate economies of scale and basically controlling the town.”

Regional Victoria

The Garden State’s compact footprint has long benefited from virtually everywhere enjoying being within comfortable drive (three hours) of Melbourne. House prices have surged outside the capital in the last 18 months, bolstered by road and rail networks being continually upgraded, to further ease the commute. This can be well observed in the network formed between Melbourne, Geelong, Ballarat and Bendigo.

“I’m seeing strong interest in people relocating from metro to regional, for a flexible working environment and more considered lifestyle,” says CBRE’s Mat George.

“There is a large focus on domestic tourism, visiting and staying within the state … the whole ‘eat play stay local’ ethos.”

A prime example of the migration can be seen in AVC’s acquisition of the Criterion Hotel in Yarrawonga, and George reports a number of regional Victoria deals in the pipeline, all setting new benchmarks, he says.

In a different tact to the reshuffling of gaming machines being seen in NSW, regional pubs in Victoria are opting to increase profitability through other means.

“Some publicans have ‘tweaked’ their opening hours,” says George. “We are seeing four to five days trade being the norm, as opposed to seven days, saving on staffing costs and thus making the venue more profitable.”

South Australia

As acquisitive hoteliers from NSW head both north into Queensland and south into Victoria, so too certain operators in Victoria are finding interest in their western neighbour. Black Rhino Hotel group already holds around 20 pubs in Victoria, with more on the way, and is now strategically snapping up select hotels in both metro and regional South Australia.

Black Rhino owner and managing director David Tomsic says he recognised the opportunities around the right capex at both f&b and gaming venues, particularly as the state adopts gaming machine legislation change allowing note acceptors.

“Our plan is to buy pubs, keep the existing staff and inject some capital, upgrading the product on the floor and delivering high quality venues to the patrons,” says Tomsic.

Separately, new vehicle Duxton Pub Fund, led by SA hospitality stalwarts including Martin Palmer, are ready and have begun to amass their own major portfolio in the state.

“In recent months we have seen some of the highest prices and sharpest yields being paid on record for gaming assets, both leasehold and freehold,” says Mat George. “Prices have well and truly surpassed previous levels, fuelled by the low cost of debt and rebounding trading results.”