FEATURE - Real Estate snapshot

Aussie Hotel Sector Set to

Spring Into 2023

The Australian hotel sector has recorded another record year of transactions amid full rebound, and indicators are good for the near future.

Jane Louise reports

FEATURE - Real Estate snapshot

Pubs and hotels across Australia have recovered more quickly from the pandemic than was anticipated, and the industry is expecting to see continued growth in investment into 2023.

Despite inflation uncertainty, Australia’s hotel sector is still attracting strong levels of investment following the period of closures and trade restrictions during COVID-19, according to Savills Australia’s latest Hotel Market Overview Q3.

Overall, things are looking up and are expected to stay this way through the course of the coming year. Aside from strong levels of investment, accommodation occupancy rates are steadily rising, and the positive outlook has had investors re-branding and updating their assets.

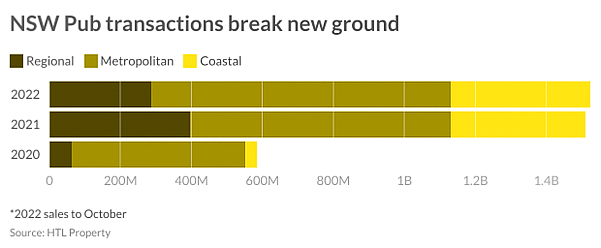

Predictions of around $2.5 billion in hotel transactions for 2022 are close to being met as regional and coastal pub markets also soar, driven by low interest rates and an expanding buyer pool, and many privately owned generational assets coming to market after struggling with the pandemic period.

While investment has slowed somewhat in recent months due to the increasing cost of finance, there has been little impact seen in quantity or quality of hotel sale transactions.

New South Wales saw the largest pub sale on record, with Casula Crossroads changing hands for $150 million.

A startling increase in the cost of poker machine entitlements has also pushed the increase in hotel values. Entitlement values now average $650,000, after averaging less than $300,000 in 2020.

With the increase in sales comes a trend for re-branding, such as for the iconic Telegraph Hotel in Hobart’s $5 million restoration and new rooftop space, plans for the New Victoria Tavern in Sydney and a $3 million update of the Coomera Lodge Hotel on the Gold Coast, making the most of the natural surroundings of the 1885 establishment.

The activity has bolstered the re-emergence of dormant prospects, like the blank slate Clarence Hotel in Maclean NSW, repaired and ready for a new life with the necessary approvals already secured.

While sales are faring well, hotel yields have been squeezed historically tight. This is amplified by investors focusing on assets requiring capital investment. According to Savills, while operational cash flow has been positive, initial yields over the first three quarters have been materially different to the long-term average of 6.07 per cent.

FEATURE - Real Estate snapshot

Accommodation occupancy levels have risen, with most state markets back to pre-COVID-19 levels. This has been boosted by a reduction in the availability of AirBnB properties.

According to Deloitte Access Economics, Australia can also expect an extended period of weakened dollar, with the Australian currency hovering around US$0.70.

The weakened Aussie dollar has led to an increase in the number of travellers to Australia.

In September, Sydney recorded its highest average daily rate (ADR) since February 2018 at $253.79 while in the same month Perth beat its highest ADR, from March 2015.

Brisbane and Perth have charged ahead at mid-70 per cent occupancy levels, with Melbourne and Sydney hot on their heels at mid to high 60 per cent levels.

The best performing market is still the Gold Coast, with revenue per available room (RevPAR) at $178.37 in Q3.

Savills national director of valuations and advisory – hotels, Adrian Archer, stated that occupancy statistics are set to rise further, as AirBnB stock dries up due to high demand in the regular rental market from residential tenants.

One of Australia’s most stable performers is Adelaide, showing leaps forward across RevPAR, ADR and occupancy growth. Spring 2022 recorded the highest number of Adelaide rooms filled in one night in its history, due to major events such as the AFL Masters Carnival, World Indigenous Peoples Conference on Education (WIPCE) 2022, and other major conferences.

This should and has set some investors’ eyes on Adelaide hotels, with occupancy levels expected to remain strong due to limited new supply.

Accommodation has been increasingly underpinning pub-style hotels nationally, and particularly on the east coast. Some pubs, such as Victoria’s Mitta Pub, have included accommodation as part of the growth strategy, making the most of a huge beer garden and picturesque setting.

Similarly, the Hotel Cecil of Casino in New South Wales has opportunities lying in the unutilised upstairs accommodation, along with surplus land at the rear. It recently sold to Barham Hamarashid, who also holds the deeds at the Winmalee Tavern, Highlands Hotel in Mittagong, and the Evening Star in Surry Hills.

And recently divested by Daniel Whitten to an acquisitive Sydney operator with a short-term leaseback, the Gunnedah Hotel already enjoys the fruits of high occupancy levels of the 28 refurbished accommodation rooms.

IN SUMMARY

Increasing levels of attention are expected from offshore investors in 2023, due to the Australian dollar being at its lowest against the US dollar since peak COVID-19 and the global financial crisis. The weak dollar will also benefit tourism and occupancy rates, which are similarly expected to remain strong.

Moving into 2023 and beyond, agents anticipate that at least in the short term the continued appetite for investment and a slowing rate of sales will keep hotel values strong.